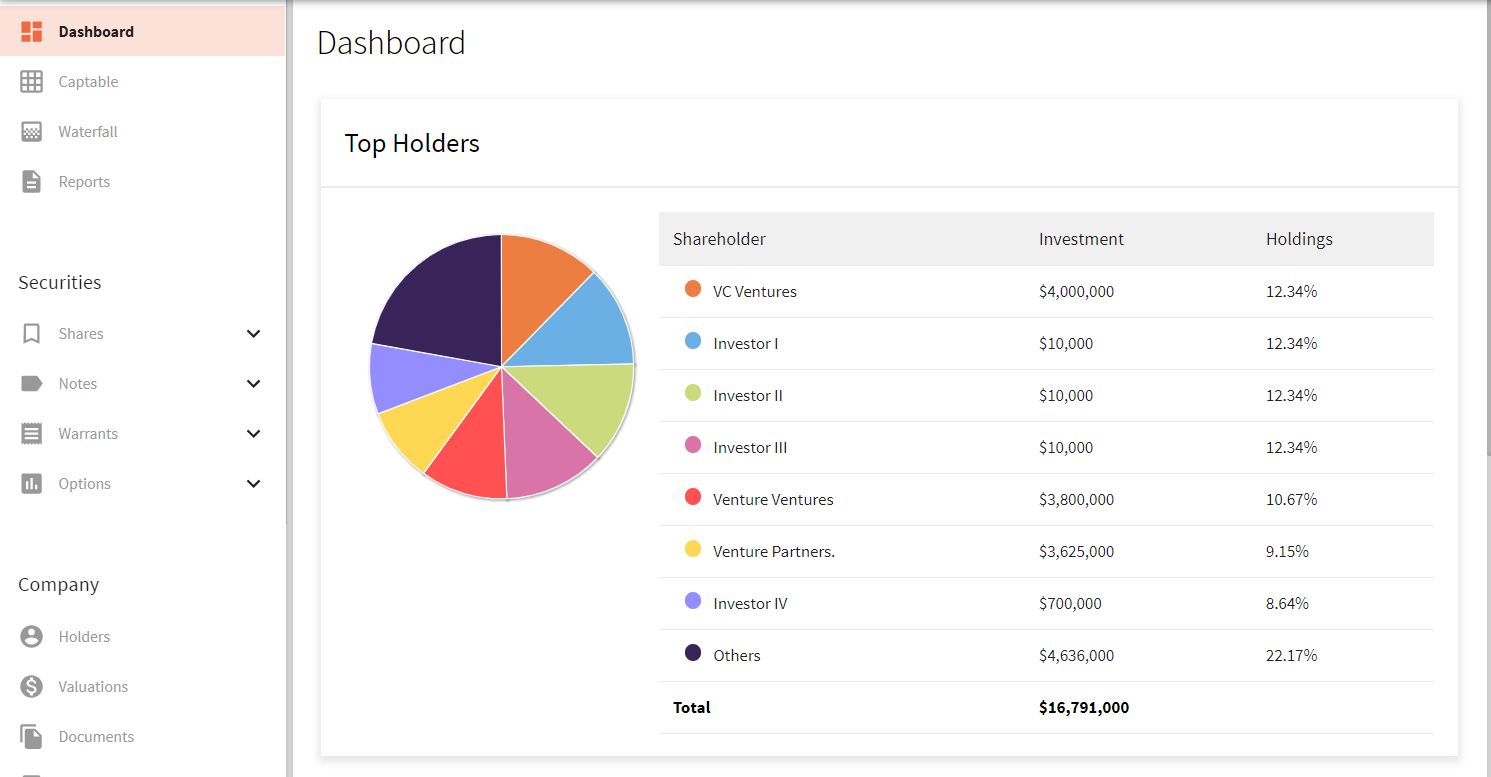

More Clarity Added to Secondary Transactions in Waterfall

There has been some confusion regarding the way preference and multiples are calculated in the waterfall for secondary transactions in Diligent Equity. To make the waterfall display more understandable, we’ve introduced a few new changes.

We’ve added a new column called “Preference Stack”, which can be understood as additional information to ”Investment”. Short explanation for what the columns do: Preference Stack is what preference is based on, and Investment is what the profit is calculated with. These two columns will show the same amount most of the times, unless the allocation resulted from a secondary transaction, please see the example.

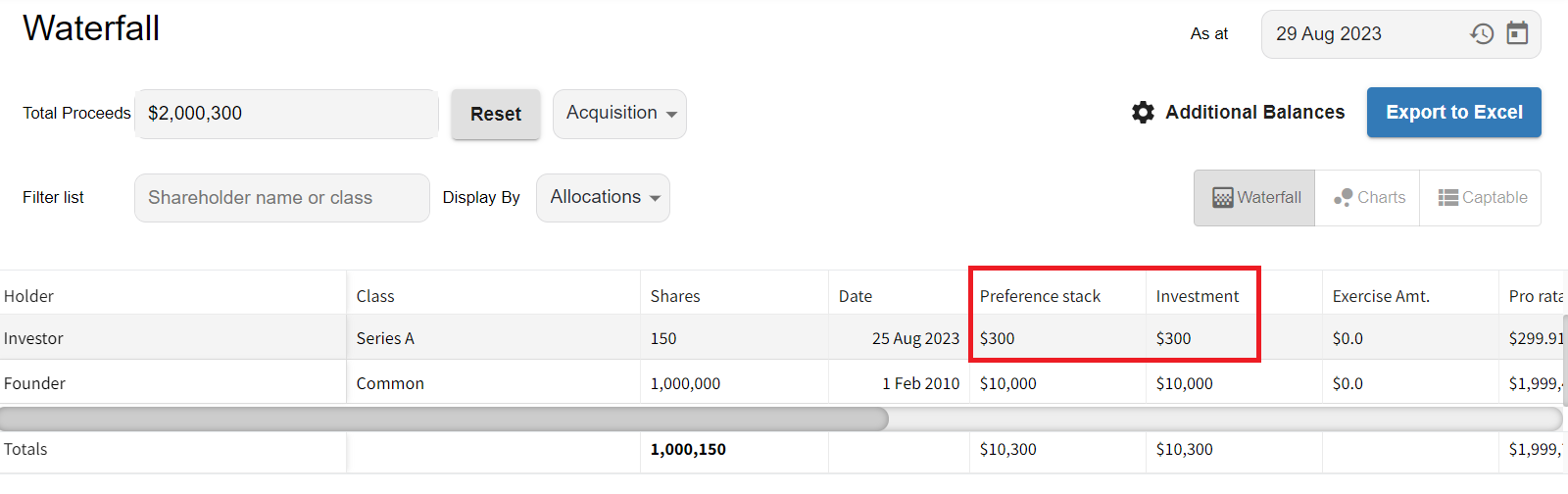

Without secondary transaction:

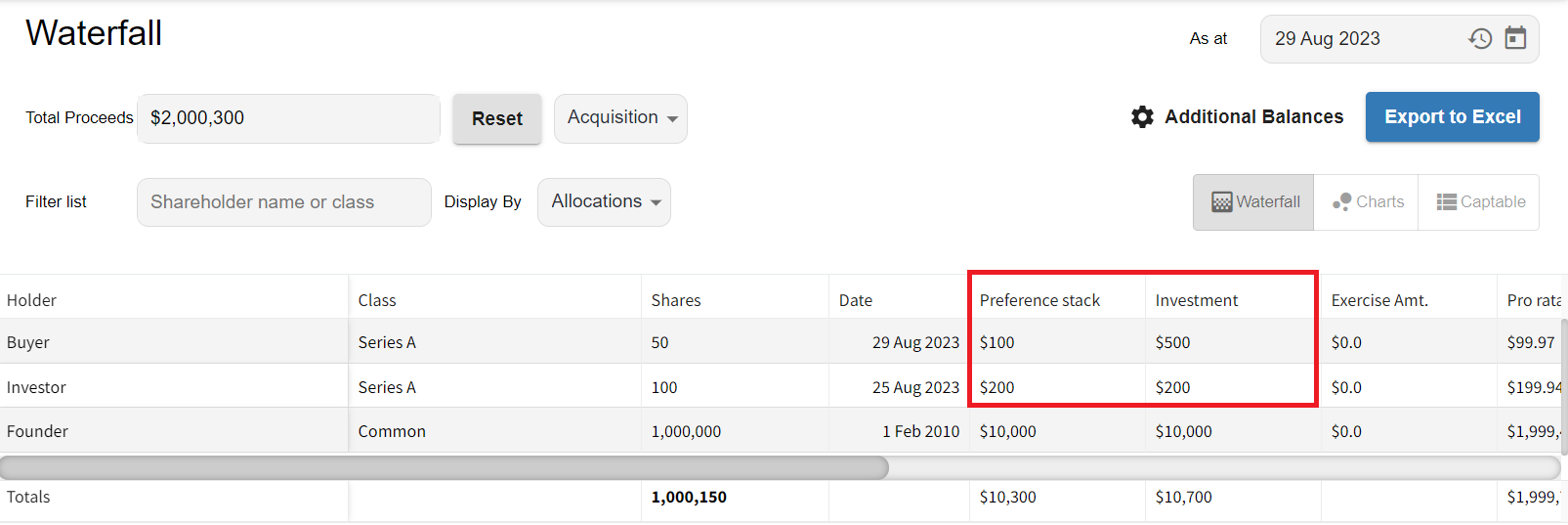

When secondary transaction comes in:

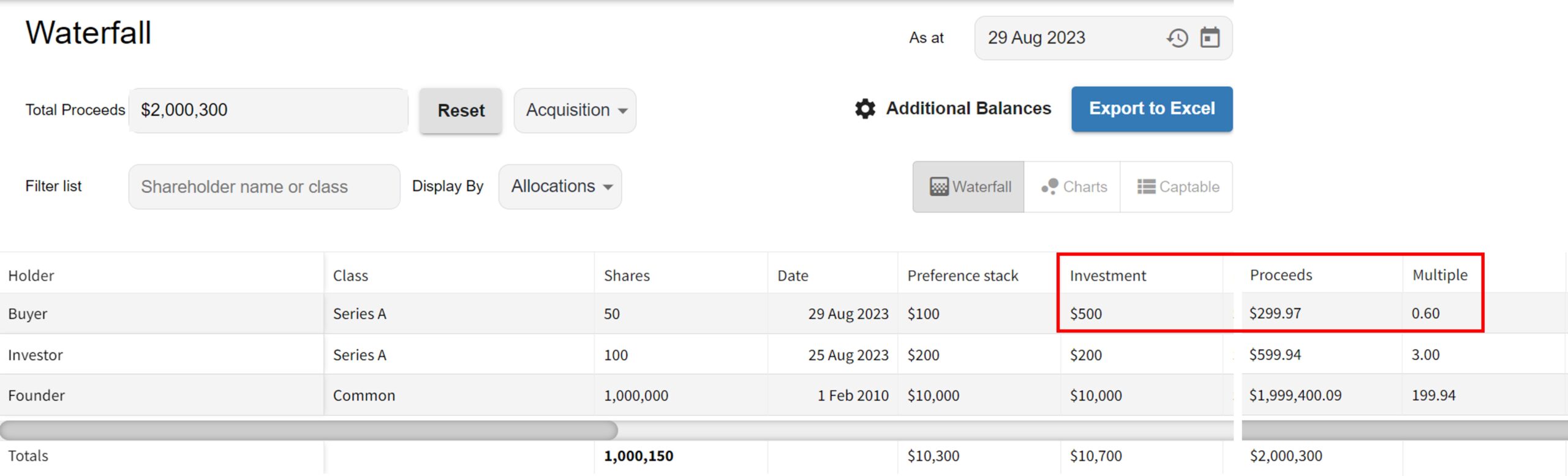

As seen in the example, for the original investor both values will still be the same, but for the buyer the two amounts do not match.

Lets take the values in the screenshot above as an example. Investor originally bought 150 shares at 2$ PPS. Buyer bought 50 shares from Investor at 10$ PPS, making it a secondary transaction. This means that Buyer invested 500$ (50*10), and Investor made 500$ on the sale.

With these example values, it is visible that Investor’s preference stack and Investment goes down by a hundred, to 200$ both, while Buyer’s preference stack will be 100$ and his investment will be 500$.

The reasoning behind this calculation

Preference Stack column:

The preference stack will show the amount that the investment is actually worth for the company, rather than the invested (paid) amount from the secondhand buyer to the original investor/owner of the shares. This means that the waterfall will calculate with the original share price, rather than the price at which the shares were sold to the second hand investor.

For example, in the case of the above, although Buyer pays 500$ for 50 shares, the preference stack will be a 100$, since originally „Investor” bought the shares at 2 PPS, meaning 50 Shares * 2$ PPS equals 100$.

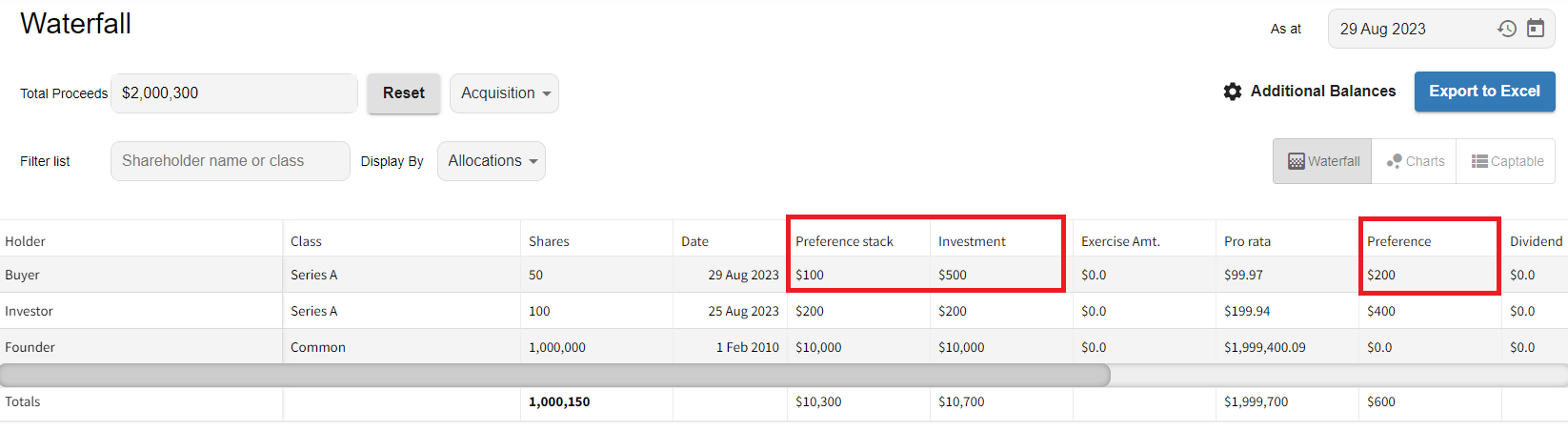

The preference stack value is the basis for calculating the Preference field, since the preference stack is not a direct investment to the company, the liquidation preference is going to remain the same, and will calculate with the original investors agreements.

Eg.: Investor invests 300$, at 2$ PPs, at a 2x liquidation preference, which means that Investor’s liquidation preference is 600$. Buyer buys 50 of the 150 shares Investor owns, for 500$. In this case the buyer bought 1/3 of Investor’s shares, which makes him own 100$ of the original investment, making his Preference 200$ (100$ *2x liquidation pref.), see on the screenshot below:

Investment column:

The Investment column shows the amount that the investor actually invested. Let’s stick to the example above, where Buyer bought 50 shares for 500$, in this case the Investment column will show 500$.

There are 2 other columns that are calculated with the value in the Investment column, the Multiple and the IRR.

Eg. for the multiple calculation: Buyer buys 50 shares at 10 PPS each from Investor. This means the Investment column will show 500$ for Buyer. The Proceeds in this case is 299.97 (200$ from Preference and 99.97 from Pro Rata), and since the multiple is calculated by dividing the value in the Proceeds field by the value in the Investment field, the multiple is going to be 299.97/500 = 0.599 rounded to 0.60.

See the example on the screenshot below:

Hopefully, these new changes can clarify some of the concerns regarding secondary transactions and the calculation methods about them.