How to Simplify the CARES Act Application Process by Using EquityEffect

Many EquityEffect clients have seen immense changes to their operations and strategic visions due to the COVID-19 global crisis. Small businesses, in particular, have experienced profound impacts of supply, demand, distribution, personnel, regulatory, and macroeconomic disruptions over the past month. Whether the clients are small businesses themselves, hold stake in them, or are strategic partners with them disruptions are being felt up and downstream.

Venture capital firms are in scramble mode to analyze new scenarios, shift funding allocations, and find ways to keep their portfolio companies in business. Many portfolio companies are reducing operations and personnel, while others are agile enough to pivot, and still others are ramping up as demand for their products or services increases. The struggle for VCS now is to predict the best ways to balance out the overwhelming short-term needs with long term potential with limited capital on-hand available for distribution. There is a lifeline, however, that VCs must consider for each of their companies to continue operating as a going concern.

On March 25, the $349 billion CARES Act was passed to allow the U.S. Small Business Administration (SBA) to provide relief for small businesses through the Paycheck Protection Program (PPP) or an Economic Injury Disaster Loan (EIDL) advance. On April 3, approved lenders began accepting applications from small businesses and sole proprietors, and independent contractors and self-employed individuals can now begin turning in their applications.

How Venture Capital & Law Firms can help their portfolio companies navigate the crisis

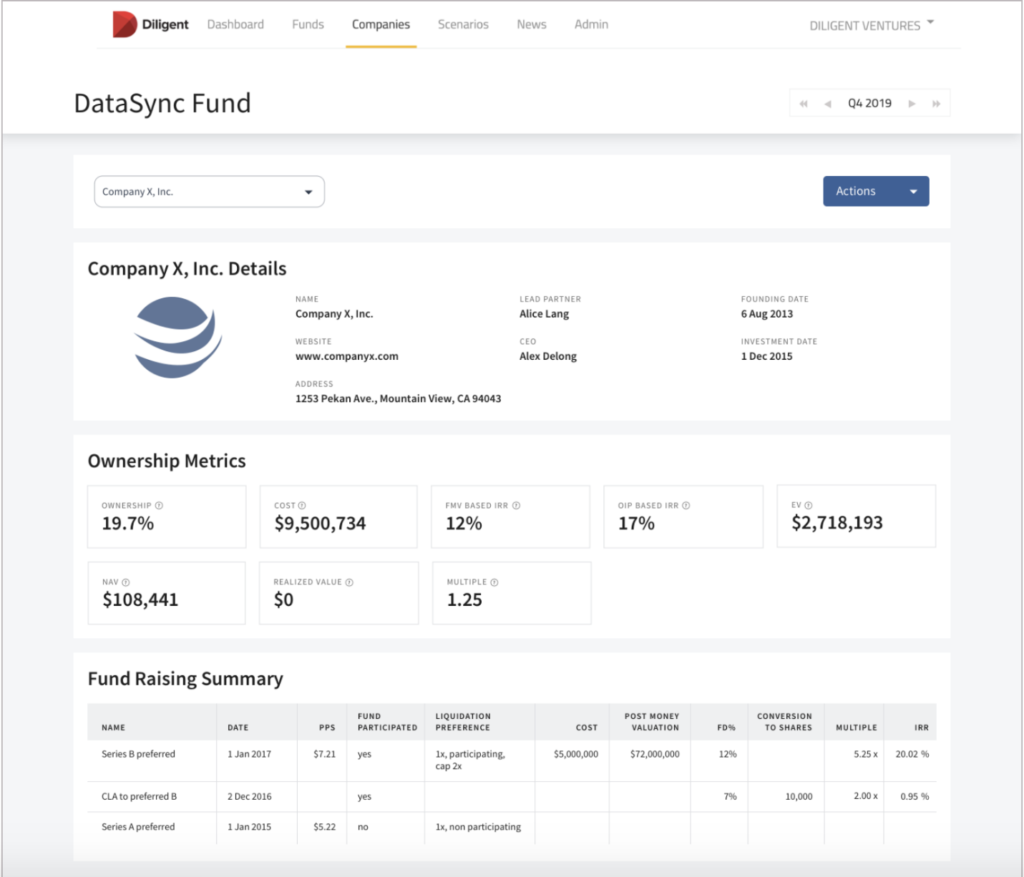

The first way venture capital funds and law firms can manage weathering this pandemic is to review which of their portfolio companies and customers are eligible for CARES Act loan support and to provide them with information needed for the applications. Launching this week, EquityEffect Investor and EquityEffect Law customers can view all the individual company information shown in the previous section for the companies they invest in or manage.

Easily view ownership metrics of portfolio companies in each company’s dashboard or exportable tear sheet.

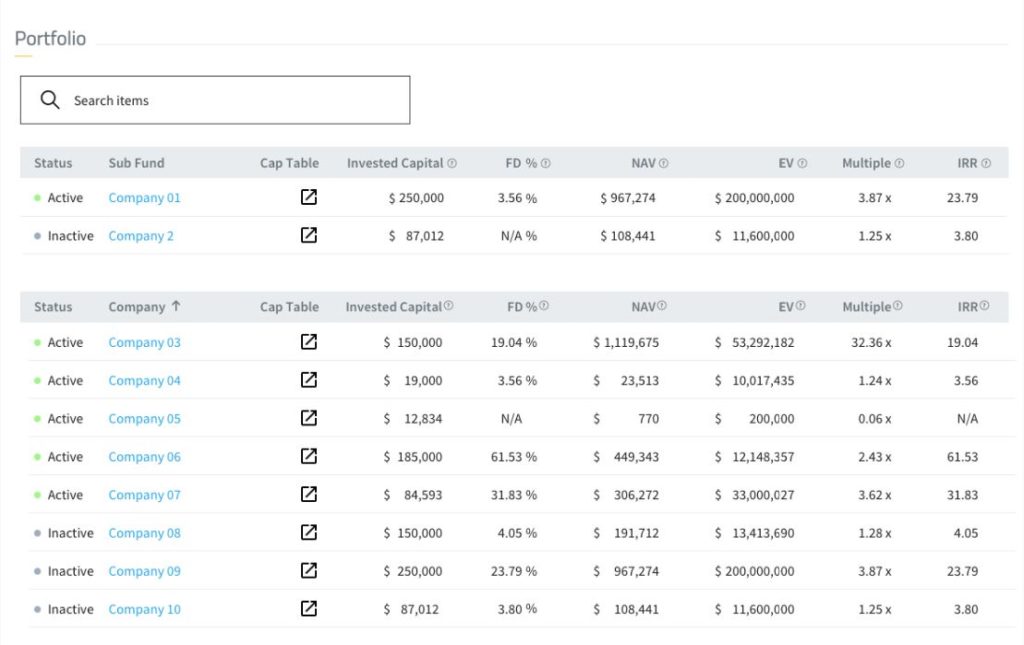

Full portfolio views allow VCs to quickly compare performance and potential in portcos

Tools within EquityEffect Investor such as scenario modeling, KPI tracking, valuations recording and management, and LP engagement are even for crucial during this time.

Scenario modeling

Forecast baseline, best-case, and worst-case scenarios across all your funds and portfolio companies. Reviewing these projections will help identify areas of greater upside and greatest need for short term capital allocation.

KPI tracking

View portfolio company performances in current climate versus beforehand. This will help VCs analyze risks and opportunities to make the right decisions as early as possible to increase the likelihoods of companies achieving their best-case scenarios.

Valuations management

If company outlooks have materially changed in the past month, it may be a good idea to review its current valuation and consider if it is still appropriate. Remember EquityEffect will retain all valuation information over time and has partners for 409A and ASC820 valuations should they be necessary.

LP engagement

With the current shakeups to companies and entire industries, investors are going to want insights on investment performance. Fund managers can easily export audit-ready reports to share with LPs on the status of their investments in seconds.

Moreover, EquityEffect’s investor portal will give limited partners invaluable insight into their investments with your funds. With all the GPs, CFOs, and associates need to manage – ad hoc reporting to LPs can become overwhelming. Giving your LPs transparency into the latest projections for their investments will save VCs hours of added stress as they manage their portfolio.

How EquityEffect helps private companies with their loan applications

While much of the information small businesses need to apply for either PPP or EIDL assistance such as payroll, mortgage interest, rent, and utility costs are often stored and maintained in accounting software, EquityEffect provides indispensable ownership information. Ownership information often stored in EquityEffect includes the current fully diluted share holdings along with details on protections and limitations for every share group. EquityEffect clients who also utilize BoardEffect, Diligent Boards or Diligent Entities will have board and entity governance materials at their disposal as well.

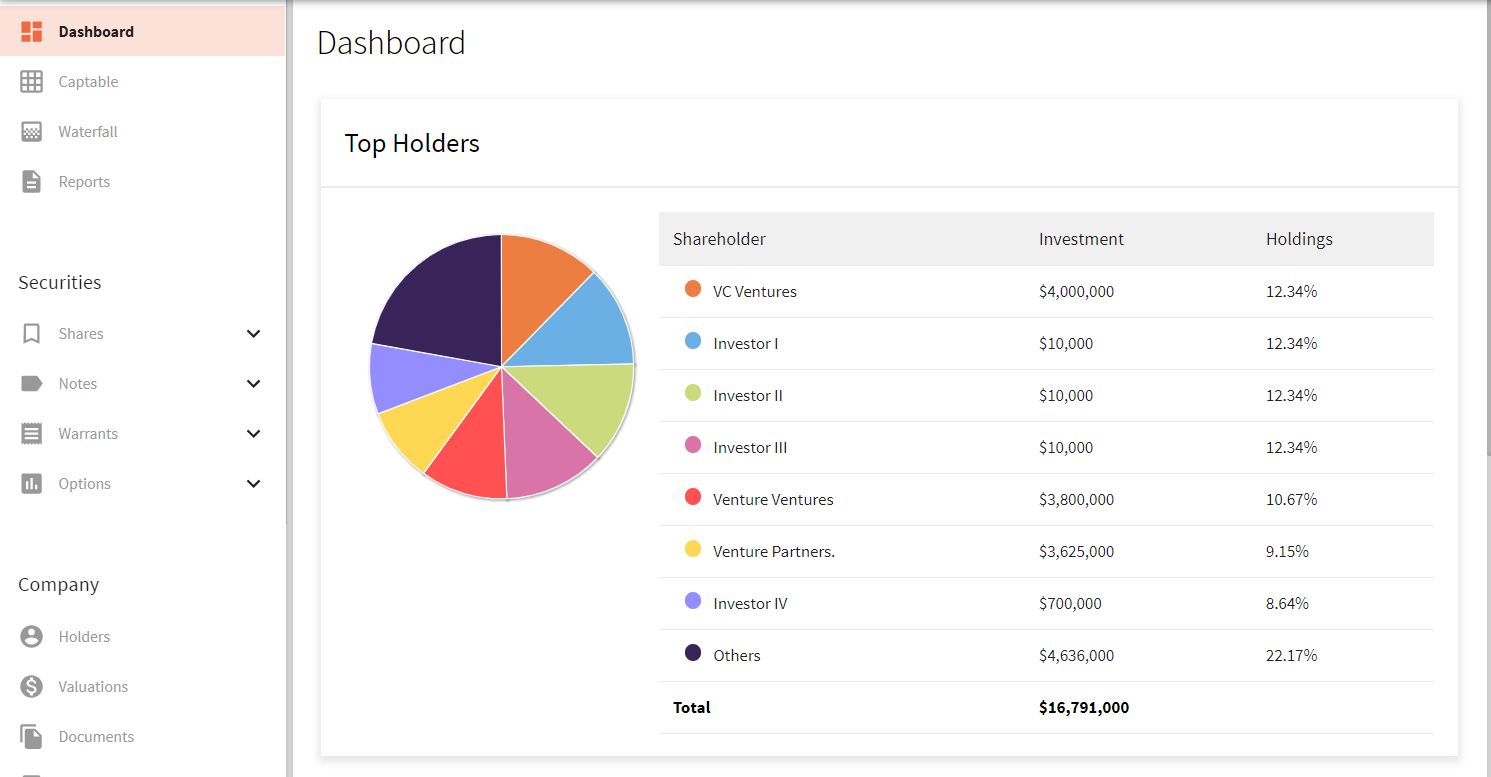

Applicant businesses (including partnerships, corporations, and LLCs) MUST report all partners, owners, and members owning 20% or more of the company along with any Trustor for organizations owned by a trust. For business customers, EquityEffect allows you to view the most up-to-date information on the fully diluted ownership of your business.

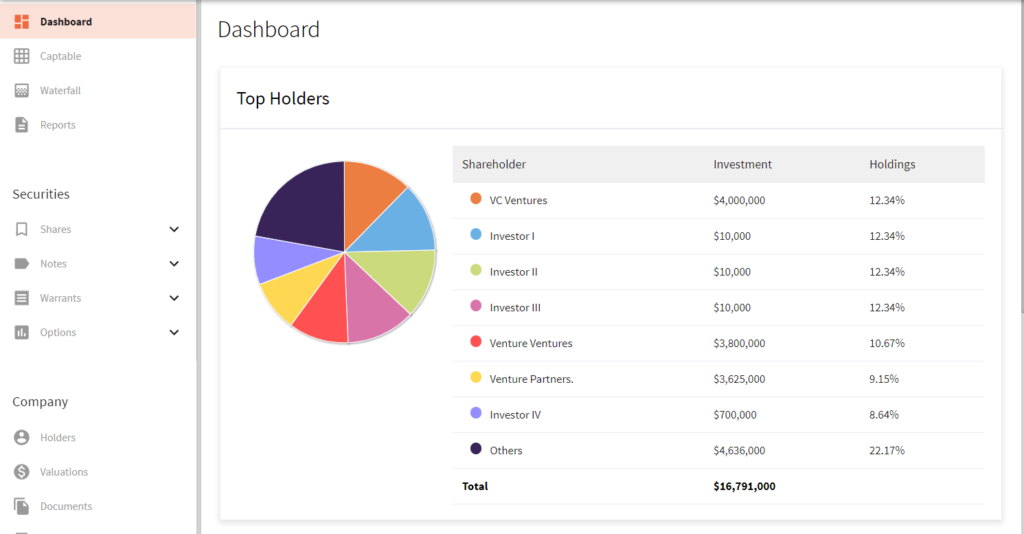

The dashboard view will help to quickly identify if any individual investor owns over 20%.

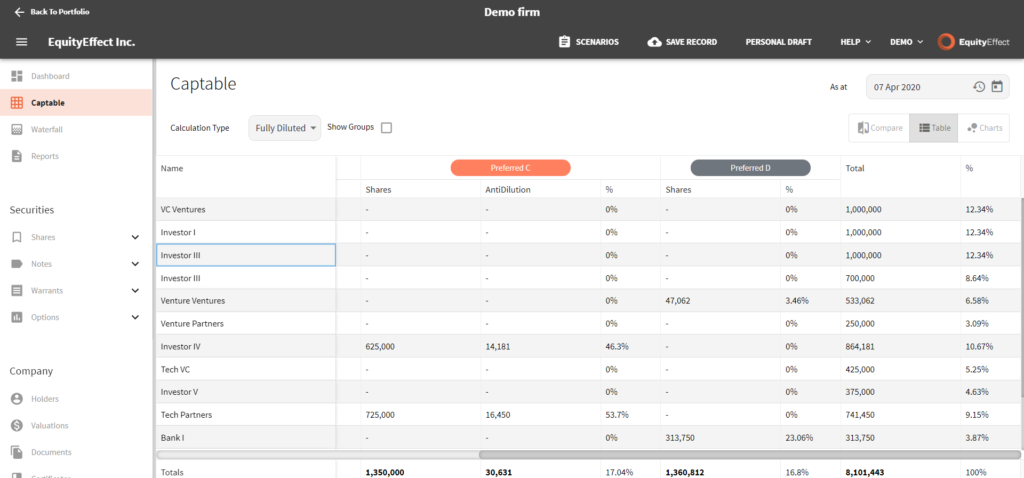

Viewing a company’s fully diluted cap table will show, in detail, each investor’s current ownership.

This is an unprecedented and difficult time for us all, and as individuals and organizations adjust to the current and the next normal, the EquityEffect team wants to provide valuable resources to its start-up, investor, and law firm community.

For additional support or questions on how EquityEffect can help your organization or constituents, please contact [email protected]. For sales assistance or more information on EquityEffect contact [email protected] or visit equityeffect.com.