Get Ready for a 409A Valuation: The Complete Checklist

As of January 1st, 2005, the American Jobs Creation Act was amended to include Section 409A of the Internal Revenue Code (IRC). The regulation refers to rules surrounding non-qualified deferred compensation. This regulation aims to ensure that companies aren’t issuing stock options below the Fair Market Value (FMV).

Essentially, the 409A rules apply whenever there is a deferral of compensation (occurs when an employee has a legal right during a taxable year to compensation that’s payable in a later taxable year). A 409A valuation is a valuation of the common stock of your company. It’s required in order to issue stock options to your employees.

Ideally, it’s best to have an independent third party perform your 409A valuation. The process is apt to go more smoothly when you keep your cap tables continually updated and take the time to gather all the proper data and documents together for the valuation.

The list of documents that you’ll need for your 409A valuation is fairly extensive. Your appraiser may ask for additional documents as the process moves along, but you can get ahead of the game by getting the required documents together and organized.

To simplify the process, we’ve put together a complete checklist for your 409A valuation. But before we get to that, remember Diligent Equity helps get the data required together and has preferred pricing with top 409A providers. Request more information here.

The Complete Checklist for a 409A Valuation

By running down this handy checklist for a 409A valuation, you’ll be prepared to start your valuation. Here’s what you need:

- Basic company information, including corporate documents such as your Articles of Incorporation and corporate bylaws. If you’ve made any changes to your Articles of Incorporation (for example, adding classes of shares), you’ll also need to provide a copy of the amended and restated Articles of Incorporation.

- As part of your company information, you’ll also need to provide biographies of management. Put them in writing or provide a link to the management biography section of your website.

- Your appraiser will also want to learn some general information about your company, such as your company’s history, type of industry, sources of revenue, names of major competitors, dynamics of the industry, etc. These details could be crucial in how the appraiser approaches your valuation.

- If you’ve had a 409A valuation performed in the past, the appraiser will also need to review all previous IRC Section 409A valuations.

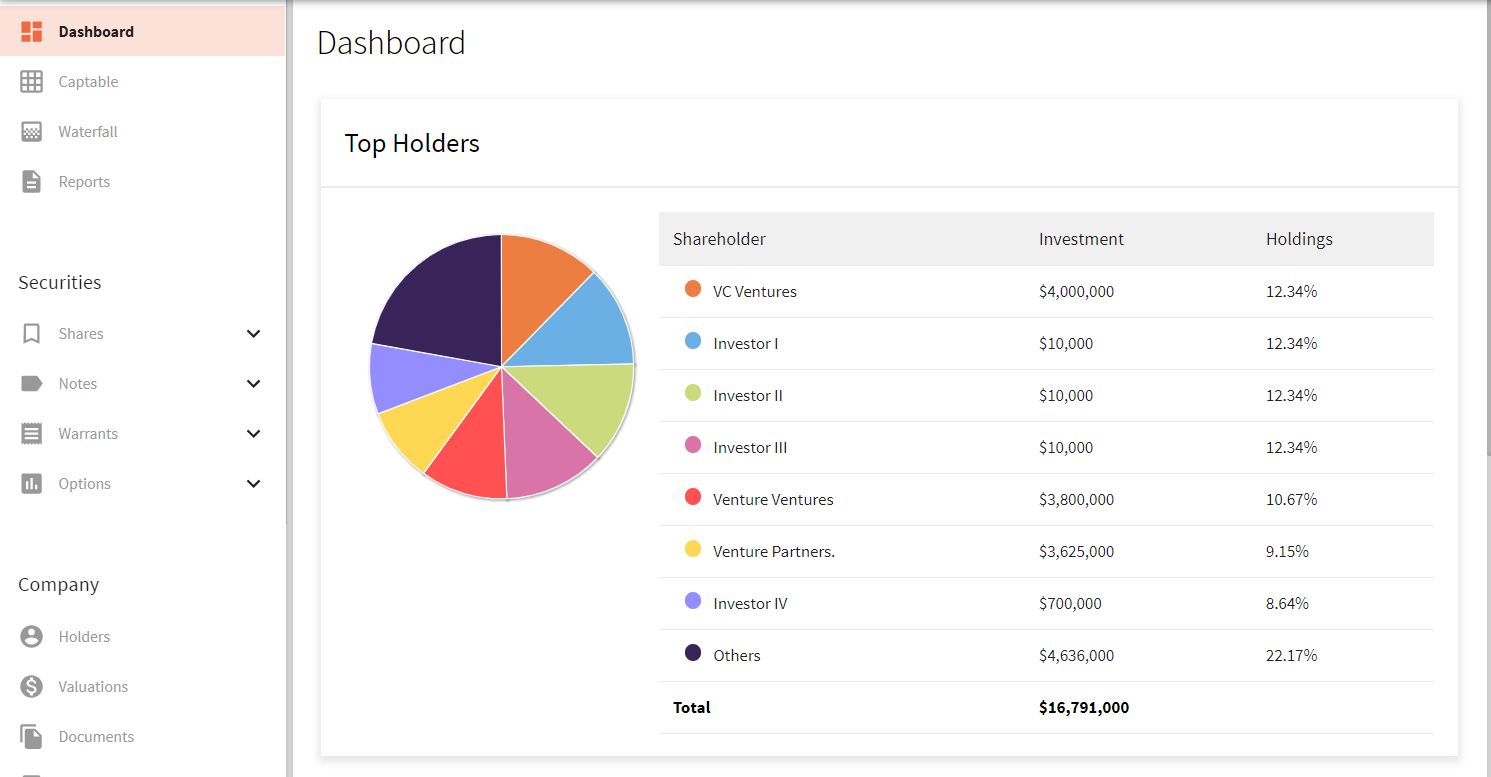

- Provide a copy of your capitalization (cap) table.

- Every company (including new corporations) needs to provide a year-to-date income statement for the period ending on the valuation date.

- It’s necessary to provide a balance sheet as of the valuation date.

- You’ll also need to provide a trial balance sheet.

If your company has been in existence for over one year, you’ll also want to gather the following documents together:

- Income statements for the last five years (or since it was incorporated).

- Balance sheets for the last five years (or since it was incorporated).

- Cash flow statements for the last five years (or since it was incorporated).

You’ll have a few more bases to cover if your company falls into the category of having meaningful revenue. Meaningful revenue refers to using revenue to value your company. If you believe this would apply to your company, add this item to your checklist:

- Expense and tax rate projections for the last five years, along with income statements.

You may not need these documents if your appraiser doesn’t do a discounted cash flow calculation. If the appraiser asks for them and they’re ready to go, it won’t delay the completion of your valuation.

If your company has subsidiaries that have separate accounts, you’ll also need to add this item to your checklist:

- All the same financial information as noted above for each subsidiary.

Companies that have issued stock options or warrants will need to gather:

- Schedule of options and/or warrants.

Companies that have outstanding debt or convertible debt will also need to provide copies of:

- Debt agreements.

Exceptions to the Section 409A Rule

For the sake of clarification, certain types of compensation are excluded from the Section 409A rules, such as the following:

- Qualified pension plans

- 401(k) plans

- Vacation leave

- Sick leave

- Disability pay

- Death benefits

- Short-term deferrals

- Specific stock options and stock appreciation rights

- Certain separation pay plans

When Do You Need to Do a 409A Valuation

When do you need to do a 409A valuation, and how often do you need to do it? Three situations trigger the time for companies offering common stock options to do a 409A valuation:

- Before the company issues its first round of employee stock options.

- Annually (this is because the share price from 409A valuations is valid for 12 months).

- Whenever your company closes a new funding round.

There’s a reason that your company may need to conduct a 409A valuation before 12 months pass. If your company experiences a material event that would affect the value of the company, you’ll need to do a 409A valuation.

What’s considered a material event?

- New equity financings

- An acquisition offer by another company

- Specific instances of secondary sales of common stock

- Significant changes to your company’s financial outlook (these could be positive or negative changes)

It’s common for companies approaching the IPO stage to conduct 409A valuations frequently, sometimes as often as quarterly or monthly.

Are There Risks for Not Doing a 409A Valuation?

Your company could face risks if you choose not to do a 409A valuation when the circumstances call for it. Unfortunately, the penalties and other tax consequences largely fall on the person receiving the stock options. The gains would be subject to taxation at vesting rather than at exercise. Also, the company would be assessed penalties and interest charges.

With this in mind, 409A compliance should be part of every investor and acquirer’s due diligence. And consider this, even if you’re able to avoid consequences from the IRS, noncompliance with 409A could negatively affect your investment or M&A processes. It’s just not worth the risk.