How to Run Cap Table Models

With so many moving pieces for founders, maintaining discipline and focus when dealing with your capital structure is critical to the long-term health of the venture. Many entrepreneurs fail to understand the change in dynamics during this critical period. Most notably, when you are taking money from outside investors, they are now financing operations!

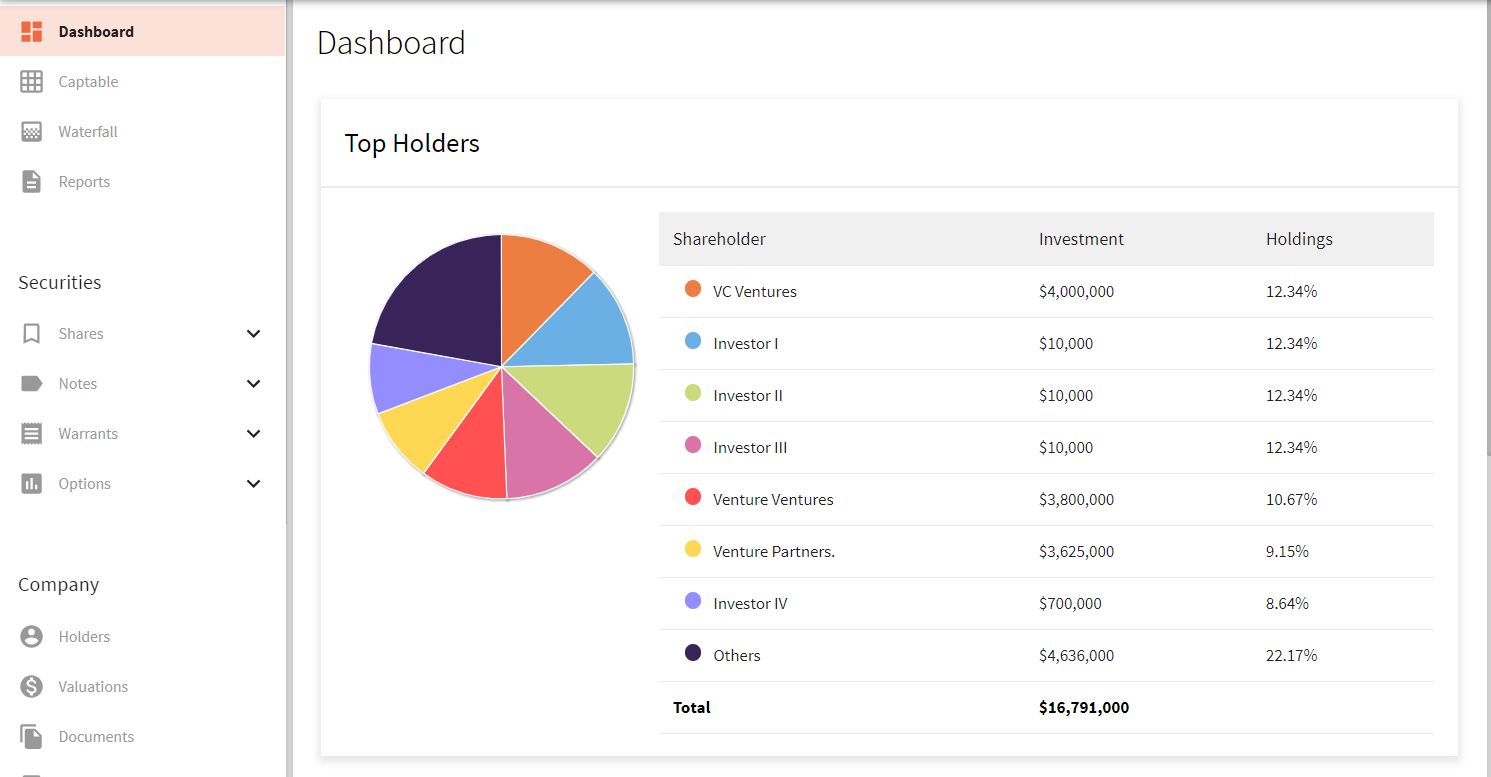

Rather than allow yourself to be deflated by this inevitable fact, take control of your cap table and understand in granular detail how bringing on new investors will dilute you and your early investors’ ownership in YOUR vision and YOUR company. Taking the aforementioned into account, it’s easy to see how that can throw a wrench in the best VC<>Portco dynamic and relationship. The numbers tell the whole story. Term sheets and modeling scenarios depict how every major shareholder is impacted in various stages and exit scenarios.

How To Compare Term Sheets

It’s common for entrepreneurs to start getting familiar with term sheets and cap tables when investors start asking for them. Term sheets spell out who gets what financially and the conditions for investment. Essentially, term sheets outline the terms of the partnership between a company and its investors.

Term sheets describe:

- Consensus valuation of the company

- Price per share of the investment

- Economic Rights

- Information Rights

The valuation portion is vital because it determines the percent of the company that new investors own. It’s a crucial figure because it directly impacts who owns what and how much they will receive once the company is sold. Overall, learning more about cap tables, term sheets, modeling and dilution will help founders make wise and prudent decisions. Founders can either leverage their law firm (at a cost) or software like Diligent Equity to make this modeling easy and quick. Feel free to start a free trial with Diligent to see how it works.

Understanding Dilution

When a company issues new shares, it decreases the existing stockholder’s percentage of ownership, and that’s called dilution. There’s also another circumstance where dilution can occur. When holders of stock options (for example, company employees or holders of other optional securities) exercise their options, dilution occurs. Every time the number of shares outstanding increases, it dilutes the percentage of the company that other stockholders own, thus decreasing the value of each share.

Dilution reduces earnings per share (EPS), and that can also negatively impact share prices. According to one source, founders experience 45%-65% dilution before exit in a typical tech startup. Obviously, dilution is a significant factor.

There are two ways to express valuation:

- Pre-money— the company’s valuation before the new investment.

- Post-money— the pre-money valuation plus the amount of the new investment.

The goal for founders is to maximize the amount of capital investment and minimize dilution as much as possible. There are a few strategies that will help to decrease the impact of dilution. Here are three of them:

- Start with ADEQUATELY SIZED option While your investors may make a suggest a particular pool size based on their previous experience, keep in mind that your investors are motivated by protecting their own dilution. Selecting your option pool to fit the hiring and implementation plan that you presented to your investors is key here. Investors may want you to overshoot in the size of you option pool…don’t let them. If they suggest a 20% pool and you know that your hiring plans only require 16%, feel free to push back.

- Raise more capital and spend it judiciously. When companies are well-managed, there’s a connection between the amount of capital that’s raised and the level of progress. In the best-case scenario, there will be an increase in the pre-money valuation before the next round and less dilution for the founders. Investors will own rights that give them a good deal of control over future financings even if they put just a little bit of money into the company. Founders need to think about subsequent financings as well as their percentage of ownership.

- Select investors carefully. Some of them are in a good position to help companies get good terms on follow-up rounds, recruit talent, and help with partnerships, etc.

Realizing the Value in Running Models

The cap table will change as the company raises capital, issues option grants, and as securities convert. Updated cap tables provide a current snapshot of the company’s valuation.

Scenario modeling is the process of analyzing possible future capitalization events. Its impractical at best to assume that what’s happened in the past will continue to happen in the future. Scenario modeling isn’t based on historical data or past trends, and it’s not intended to show the exact picture of the future. The purpose of scenario modeling is to help companies consider possible alternative outcomes and evaluate the scope of those outcomes.

Modeling helps understand the current situation, the best-case scenario, and the worst-case scenario. Modeling is also helpful for gaining insight into how your cap table will be affected in the angel round, seed round, and Series A round, and understanding outcomes at various exit scenarios.

When negotiating terms, it’s best to focus on the most impactful components. Investors make deals regularly, so they’re well versed in negotiating. Knowing that, keep in mind that you’re at a significant disadvantage. With Diligent Equity, we can help level the playing field.

Software makes it easy to manage cap tables. With Diligent Equity, in a few minutes founders can model out rounds, better understand the effects of dilution, and develop a good exit strategy. The software automates the process of running waterfall analyses within seconds, and it reflects multiple versions of future rounds without any hassle. Overall, cap table management software gives founders better visibility on the impact of future financing rounds and position them to make more informed decisions and gain a significant edge while negotiating with investors.