Why Investors Choose EquityEffect Over Other Providers

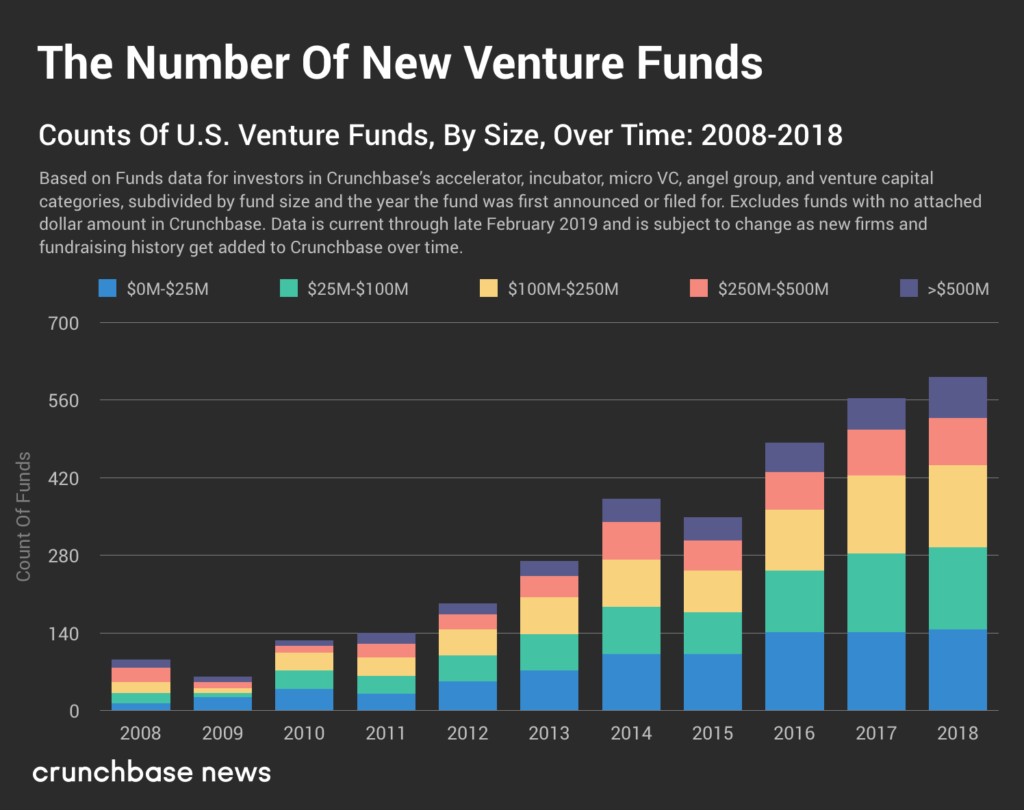

Private capital fundraising had a bombshell year in 2019. An incredible $888 billion was raised across 1,064 venture capital, private equity and other funds accounting for the most private capital ever raised on an annual basis, according to a new PitchBook report. This influx of funding has also seen the number of funds created increase almost every year since 2009 as the chart below shows.

However, according to HBR, since 1997 less cash has been returned to VC investors than they have invested. In truth the average fund breaks even or loses money. There are many reasons for this, but we believe the better a fund is at analyzing and reporting on their funds, the better the returns will be as the insights would drive better decisions and improve performance.

While that might seem straightforward, venture capitalists lack the tools needed to do the above. This is a major problem. We speak to VC’s every day and most are still manually managing their data and reporting in Excel. Not only are these methods time consuming, they are error-prone – Deloitte notes that 23% of all spreadsheets contain errors. The ironic part is that VC’s are generally at the bleeding edge of technology, yet they have few tools that truly solve their own pains points.

Funds need a unique differentiator to stay competitive in a crowded field, and we believe that access to better data will enable them to ask better questions and improve decision-making. EquityEffect strives to help you delete that Excel file, save time, gain insights and aid in your quest for larger fund returns. We see these enhancements as a clear path to moving ahead of the pack and elevating fund performance.

Standardized investment data across portfolio

A huge issue investors face, as stated above, is they do not have a single up to date and accurate view into their investments. To solve the larger problem, we first need to standardize and make investment data accessible.

At EquityEffect, our team of paralegals goes through all your deal documents to build full, detailed cap tables for each of your portfolio companies regardless of cap table solution your portfolio company uses. Most, if not all, other providers do not allow you this visibility across your entire portfolio unless all your companies use their cap table solution, and let’s be honest, that is unlikely to happen. For those that do allow this, their tools generally do not get deep enough, to the granularities to be helpful on a company by company basis. Having the data standardized is great but if you cannot action the data then what is the point? J.J. Kasper of Blue Collective noted that “now with EquityEffect, we can bring a lot of that together and have a common set of data from which we can do a lot of different things from investment performance and portfolio monitoring to LP engagement.”

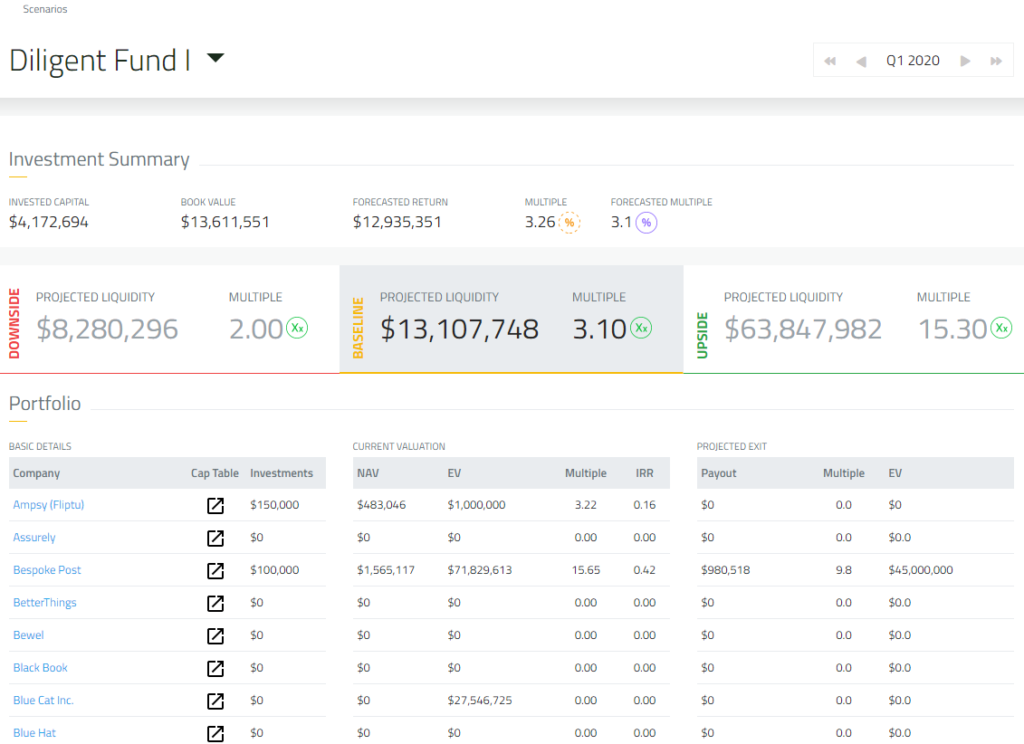

Robust Scenario Modeling & Capital Deployment Planning

The most successful funds we work with have many similarities, one of them being their constant focus on evaluating their portfolio in different ways to understand possible outcomes to inform future decisions. EquityEffect has the most powerful scenario modeling on the market at both the company and fund level. On the company level, you can use our next-round modeling to forecast a company’s next financing and to evaluate different term sheets. Then our waterfall engine makes exit planning flexible and a click of a button away. All this same robust functionality then rolls up to the fund view to make informed decisions on what could happen to your fund and where to better allocate follow-on investment to maximize your returns.

Data Sharing and Security

One key aspect to consider when evaluating vendors is how they perceive data ownership. Some vendors’ end-users are the companies themselves. Meaning that the data collected for your fund is then shared across any investor in that company regardless of access rights in the provision documents. This can be troublesome for many funds. At EquityEffect, all data provided by and collected for your fund is ONLY accessible by you. No one else. Even if another VC has invested in your same company, they need to provide their own data within the system.

Secondly, since EquityEffect is a part of Diligent, which works with +50% of the Fortune 500 & +75% of the FTSE 100, security is at the core of our duty to customers. The strictest protocols and controls are a part of the EquityEffect system ensuring the highest level of protection when it comes to your data. But bluntly, Diligent spends more on security per year than most competitors are in revenue.

Integration into your current processes

I must admit though, while I think EquityEffect is the best, it is unlikely that we will be the perfect choice for all the technology needs at a venture capital firm. Some vendors are what we call a closed eco-system and try to do all things without flexibility. For example, forcing users to use them for their software and fund administration. We think this vision is flawed for many reasons but primarily because a VC should have the ability to own its data and the flexibility to integrate it into all the tools they decide to use in their preferred workflow; not completely upend how they run their fund .

As an example, at EquityEffect we have an LP portal that allows you to communicate with your LPs securely. For those who already have a preferred investor portal that suits their needs, EquityEffect will integrate with that system. The key to EquityEffect’s success is a strong API that benefits VCs by allowing them to choose into which systems they want to share their data to improve their workflow rather than disrupt it.

This integration has changed how some customers work. Blue Collective claimed “that one of the biggest problems for us before using EquityEffect is that we had a lot of individual solutions for all the individual pieces of work and workflows that we were engaged in. None of them were probably the best fit and none of them spoke to each other.”

Another example might be how we work with your current fund administrator. Some software providers also push to move to their services, but again we think this is the wrong approach. Changing a fund admin is risky and time intensive. You likely have very strong ties to your fund administrator and would like to improve your technology without going through the time-consuming and painful process of changing your fund admin partner. We are not fund administrators, nor will we ever be . We build software and that’s where we will always focus to deliver more and more value to users. For that reason, our software is positioned as a compliment to your already great fund administrators. We have several partnerships in place with fund administrators and are always looking for more (hint hint fund admins).

In Conclusion

Again, there are many solutions on the market and many of them are great at different pieces of the puzzle. Some great questions we would encourage you to ask when evaluating which is right for you are:

- Does your platform allow me to manage all my investment data from the highest fund level metrics all the way to the mostly granular shareholder data?

- How does your system make my day to day job easier or enhance my day to day job?

- How is my data on-boarded and then managed on-going?

- Do only I have access to the data in my platform?

- Can I integrate my data into other systems?

Lastly, EquityEffect is committed to listening to our customers and allowing them to largely dictate our roadmap. We are constantly releasing new features and many of them were driven by customer pain points. Our team wakes up everything morning and goes to bed every night thinking about how to solve these pain points and make lives for investors better. You can see for yourself from one of our clients below.