Venture Capital Fund Metrics Cheat Sheet

Venture capital (VC) is a type of private equity financing many companies use to scale and grow. It requires investors to take educated risks and make calculations on companies with the potential for high growth.

Because of the risk involved, if you want to get deeper into the world of VC, it’s necessary to learn how to do important calculations to determine the state of your VC fund.

In this VC fund metrics cheat sheet, you’ll learn how to:

- Determine the performance and health of your fund using nine crucial venture capital fund metrics.

- Perform calculations for multiple and internal rates of return (IRR) calculation — and how to distinguish them from one another.

The Goal of Reporting Fund Performance

Before diving right into calculations, it’s essential to understand what you’re looking to learn. Intended for beginners and pros alike, this cheat sheet will remind you of the key metrics you should track to measure a fund’s performance. This will help you understand how well your fund and company are doing relative to others.

Specifically, the cheat sheet will help you remember and address the following:

- When should you use multiple calculations versus IRR calculations? What are the differences?

- How is your particular investment performing right now?

- How has the company performed historically?

- Which metrics are more vital to limited partners (LPs)? Which metrics are more important to general partners (GPs)?

- How is your overall fund performing?

- How is your fund doing compared to similar VC funds with the same vintage year?

- How do these returns compare to market averages?

Remember, if you need a trusty cheat sheet you can download all the material in this blog post here!

Nine Venture Capital Metrics to Determine Fund Health and Performance

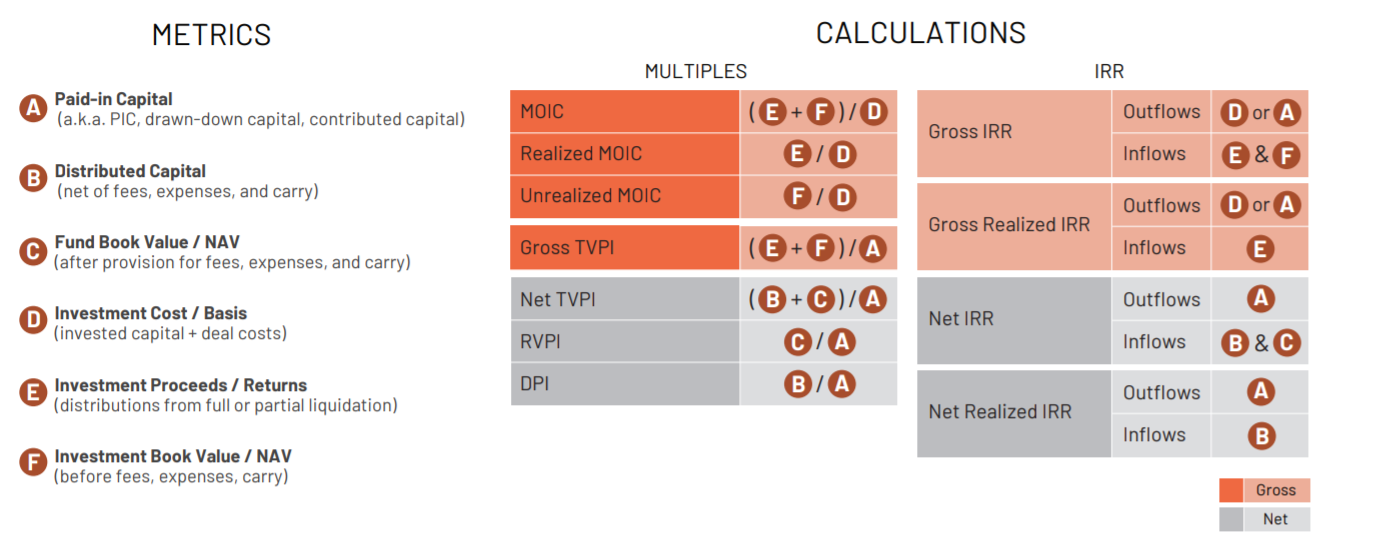

The nine venture capital metrics to determine fund health and performance are separated into multiple calculations and internal rate of return (IRR) calculations.

The multiple calculations include:

- Multiple on Invested Capital (MOIC)

- Gross Total Value to Paid-In Capital (Gross TVPI)

- Net Total Value to Paid-In Capital (Net TVPI)

- Residual Value per Paid-In Capital (RVPI)

- Distributions per Paid-In Capital (DPI)

The Internal Rate of Return (IRR) calculations are as follows:

- Gross IRR

- Gross Realized IRR

- Net IRR

- Net Realized IRR

The Difference Between Multiple and IRR Calculations

On the surface, multiple and IRR calculations look somewhat similar and are both crucial to investors. However, they ask and answer different questions.

While multiple calculations yield quick figures meant to show you the total value of a portfolio, they don’t consider time. They merely tell you how much money you’re going to receive from an investment.

In contrast, IRR calculations do consider timing to tell you how much you will make and when you will get a return on your investment. As such, IRR calculations can give investors a clearer picture of an investment’s potential.

As tempting as it is to only pay attention to IRR calculations, there’s a reason why multiple and IRR calculations are usually reported together. Together, they show you the whole picture. Accordingly, you should look at both types of calculations when determining the health of your fund.

Let’s now go through each of the nine calculations in detail. You’ll learn what these metrics are, what they represent, how to calculate them, and how to tell them apart.

Multiple Calculations for Fund Metrics

Multiple on Invested Capital (MOIC)

Also known as Gross MOIC, Book Value on Invested Capital, and Multiple on Money (MOM), MOIC compares the value of your current investment to the amount of money you put into it.

For instance, let’s say you invested $1 million, and the asset has now risen to $1.5 million. The MOIC, in this case, would be 1.5.

MOIC is best used for determining the following:

- A GP’s ability to choose investments that are likely to give good returns.

- A GP’s ability to make good raw investments.

Calculate MOIC using this formula:

Numerator: Investment Proceeds/Returns + Investment Book Value/NAV

Denominator: Investment Cost/Basis

Note the following:

- Investment proceeds or returns are from partial or full liquidation.

- Investment book value or NAV does not include carry, expenses or fees.

- Investment costs/basis consists of deal costs and invested capital.

Gross Total Value to Paid-In Capital (Gross TVPI)

Also called TVPI, Gross TVPI, and Book Value on Paid-In Capital, Gross TVPI represents a GP’s investment ability. Specifically, it measures a GP’s ability to turn an LP’s investments into big winners.

In other words, this is the current value of a fund’s remaining investments with the total value of all distributions since the beginning, over the total amount of capital put into the fund.

Calculate Gross TVPI using this formula:

Numerator: Investment Proceeds/Returns + Investment Book Value/NAV

Denominator: Paid-In Capital

Note the following:

- Paid-In Capital is how much capital investors put in and consists of the funds raised by the business through selling equity rather than from business operations.

Net Total Value to Paid-In Capital (Net TVPI)

This is also known as Net Multiple or TVPI and is often quoted by GPs. For LPs, this isn’t the most important metric but the second most important one.

Before you calculate Net TVPI, make sure you’re making reasonable comparisons between similar categories.

Calculate Net TVPI using this formula:

Numerator: Distributed Capital and Fund Book Value/NAV

Denominator: Paid-In Capital

Distributed capital is when you add together expenses, fees and carry.

Residual Value per Paid-In Capital (RVPI)

Also known as Equity Value Multiple, Unrealized Value Multiple, and Book Value Multiple, RVPI is a critical metric because it shows you how much a fund is worth on paper. In other words, it tells you how much the owner of the business thinks their business is worth.

Since RVPI is mainly used to estimate how the fund is doing in the beginning and middle of its life cycle, it can also give you a good understanding of:

- A portfolio’s potential.

- How likely it is for RVPI to turn into Distributions per Paid-In Capital (DPI), which is the most important metric to both GPs and LPs.

Calculate RVPI using this formula:

Numerator: Fund Book Value/NAV

Denominator: Paid-In Capital

Fund book value includes expenses, carry, and fees.

Distributions per Paid-In Capital (DPI)

Distributions per Paid-In Capital or Realized Value Multiple is the most important metric to LPs and GPs both. DPI tells you how much cash has come back to you, so the higher the DPI, the better.

Calculate DPI using this formula:

Numerator: Distributed Capital

Denominator: Paid-In Capital

Internal Rate of Return (IRR) Calculations for Fund Metrics

Gross IRR

This is the rate of return that can be used to measure a GP’s raw investment ability. It measures the GP’s ability to create returns based on invested capital.

You determine Gross IRR outflows by looking at Investment Cost/Basis or Paid-In Capital.

If you want to determine Gross IRR inflows, look at Investment Proceeds/Returns and Investment Book Value/NAV.

Gross Realized IRR

This is similar to the Gross IRR in that this is the best rate of return when measuring a GP’s ability to make raw investments. It measures the actual cash return on all investments and applies to securities, companies, and funds.

Before determining Gross IRR, you should clarify whether invested capital or paid-in capital was used. Be sure you know since this can have a significant impact on your Gross IRR calculation.

You determine Gross Realized IRR outflows by looking at investment Cost/Basis or Paid-In Capital.

To determine Gross Realized IRR inflows, look at Investment Proceeds/Returns.

Net IRR

Net IRR measures a GP’s skill in generating returns on an LP’s capital contributions. While GPs often mention this metric, this is only the second most important measurement to LPs.

Like net multiples, a net IRR should only be utilized at the fund level. There are many ways to dole out fees, expenses, and carry in IRR calculations’ unrealized value.

You determine Net IRR outflows by looking at Paid-In Capital.

To determine Net IRR inflows, look at Distributed Capital and Fund Book Value/NAV.

Net Realized IRR

You can use a Net Realized IRR to create a J-curve. This is the most important metric for LPs at the end of the fund because it shows an investment’s overall yield or quality.

Unlike the multiple measurements, Net Realized IRR considers the effect of costs, fees, carried interests, and other factors that IRR does not consider.

You determine Net Realized IRR outflows by looking at Paid-In Capital, and you can determine Net Realized IRR inflows by looking at Distributed Capital.

The Right Fund Metrics Matter

The complex world of VC is not always easy to understand or get into. The specifics of key VC fund metrics can be challenging to remember, particularly when there are so many of them.

This is where this cheat sheet comes in handy. These nine venture capital fund metrics and the formulas for multiple and IRR calculations are a great starting place for learning how to determine the potential and health of your funds.

In conclusion, be sure to request more information on how Diligent Equity can help you and your firm manage the large amounts of data required to manage a fund.